income tax rate malaysia 2019

The same can be said for securities sold within twelve months of its purchase. Additionally the tax rate on those earning more than RM2 million per year has been increased from 28 to 30.

Personal Tax Archives Tax Updates Budget Business News

Resident company with paid-up capital of RM25 million and below at the beginning of the basis period SME Note 1 On first RM500000.

. Another cause is the rate at which income is taxed coupled with the progressivity of the tax. Letter from your employment confirming reduction of income. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021.

No other taxes are imposed on income from petroleum operations. Under Section 77 of the Income Tax. Dasar Privasi Dasar Keselamatan.

2006-2008 26000 2009-2012 and 28000 on or after January 1 2013 including 2014 2015 2016 and 2017. Americas 1 tax preparation provider. A company whether resident or not is assessable on income accrued in or derived from Malaysia.

Check Income Tax Slabs Tax Rates in india for FY 2021-22 AY 2023-24 on ET Wealth. 0-5 tax is applicable for different age group with income from Rs. The taxpayer would also be required to pay additional tax at the rate of 25 percent if the updated return is filed in the first year or 50 percent on the additional tax if the updated return is filed in the.

Lembaga Hasil Dalam Negeri Malaysia tidak bertanggungjawab terhadap sebarang kehilangan atau kerosakan yang dialami kerana menggunakan maklumat dalam laman ini. Theres still time for you to carefully plan your purchases to maximise. Get the latest international news and world events from Asia Europe the Middle East and more.

Country Corporate tax excl. Income tax exemption is applicable on the long-term gain which occurs from the sale of a capital asset under section 54 and 54F of IT Act if the investment is made in construction and purchase of house. But keep in mind the overall audit rate is low.

Taxable income Tax on this income Effective tax rate 0 18200 Nil 0 18201 37000 19c for each 1 over 18200. For example you have until April 15 2024 to claim a 2020 Tax Refund April 15 2023 to claim 2019 Tax Refund and for 2018 until April 18 2022. If gross income is USD 100000 or less then the individuals total tax will be.

Self-Employed with reduction in income. For tax years after 31 December 2019 an individuals total tax will be 95 of ones total tax determined regular tax plus gradual adjustment if gross income exceeds USD 100000. In 2018 2019.

1 online tax filing solution for self-employed. For all other back taxes or previous tax years its too. Valid for an original 2019 personal income tax return for our Tax Pro Go service only.

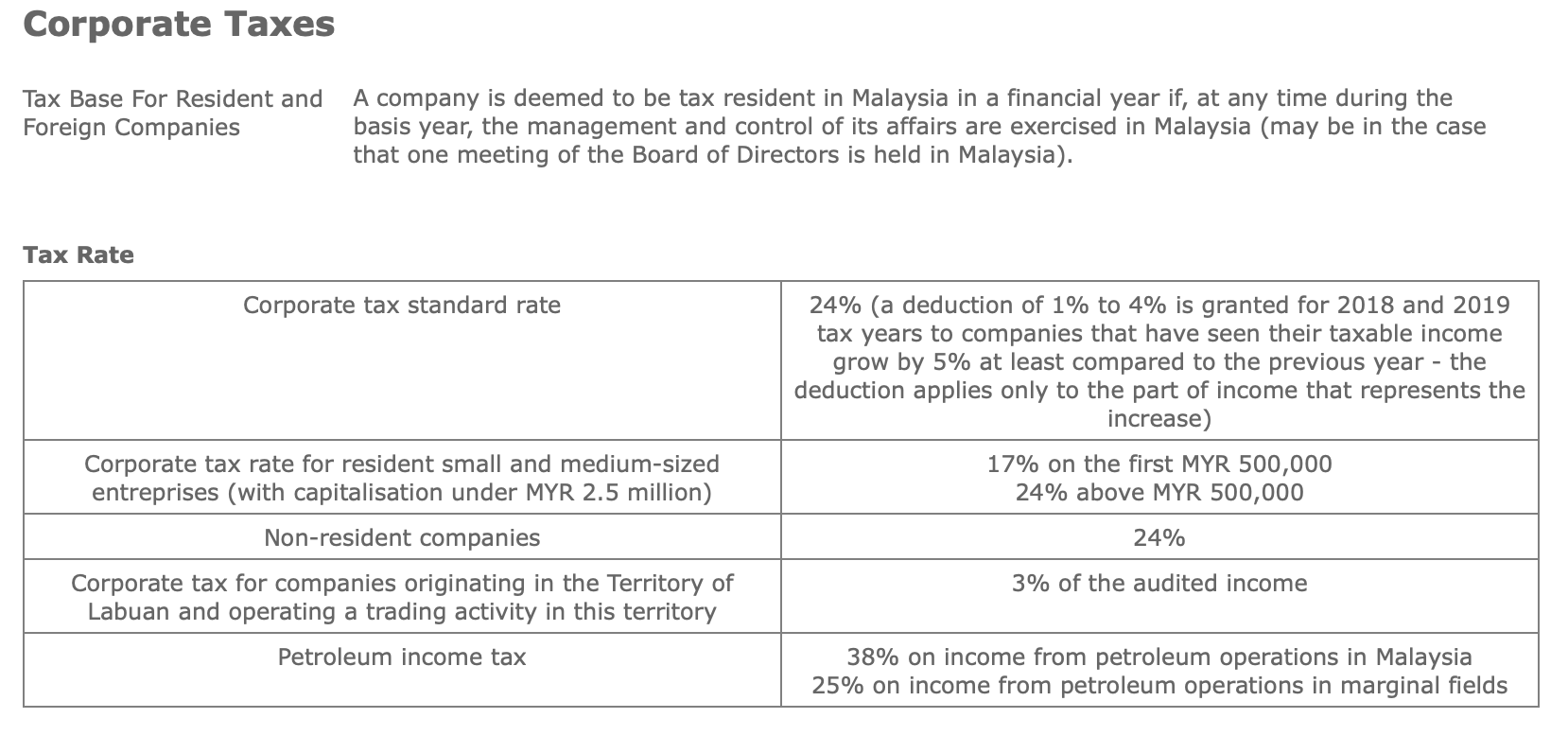

In 2016 the Inland Revenue Board of Malaysia lowered the effective tax rate to 24 for businesses with capital exceeding 25 million ringgit. Bank Statements reflective of at least 50 income reduction in the past 2 years. 7000 27970 250.

Self-Employed defined as a return with a Schedule CC-EZ tax form. Tax is a tax by which the tax rate increases as the taxable base amount increases. Any one 1 of the following documents.

Any one 1 of the following documents. Short-term capital gain attracts a flat 20 tax. General corporation tax rates.

Under the Section 11A on the Income Tax Act equity and equity shares funds that have been sold in stock exchange and securities transaction tax on such short-term capital gains is chargeable to tax at a rate of 10 percent up to 2008-9 and 15 percent from 2009-10. We provide a list of income tax and financial changes applicable in India during FY 2022-23 that is April 1 2022 to March 31 2023. Further to bring down the gross total income an individual was allowed to claim deductions under sections like 80C 80D etc.

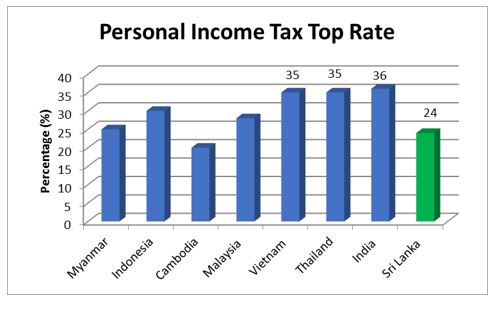

No tax is applicable for individuals whose income is less than Rs. Till FY 2019-20 there was only one tax regime with four tax slabs and tax rates. In a progressive tax system the level of the top tax rate will often have a direct impact on the level of inequality within a society.

The rate is 10. Malaysia adopts a territorial system of income taxation. Income Tax Facts In Malaysia You Should Know.

There are no other local state or provincial. On July 24 2019 the Malaysian government as the plaintiff filed a writ of summons through LHDN at the High Court naming Nooryana Najwa as the defendant. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing.

Tax Rate Taxable Income Threshold. Malaysia was ranked 33rd in the Global Innovation Index in 2020 up from 35th in 2019. For the smaller companies the rate is 19.

If the answers to your questions can not be found in these resources we strongly recommend visiting with a tax practitioner. Dividend taxes Lowest marginal rate Highest marginal rate VAT or GST or Sales tax Capital Gains tax Further reading Afghanistan 20. To understand this let us take an example image Mr.

0 However in Taliban run areas small fees have been illegally added to some groceries. In this situation Rs4 000 is deductible for the last year. You can roughly estimate how much tax savings you will be able to make when you file for your tax in 2019.

Income Tax for Year of Assessment 2019 AND latest Income Tax Assessment. Must provide a copy of a current police firefighter EMT or healthcare worker ID to qualify. Financial years 201819 201920.

The normal rate of corporation tax is 19 for the financial year beginning 1 April 2021 and will be maintained at this rate for the financial year beginning 1 April 2022. And tax exemptions on house. Offer valid for returns filed 512020 - 5312020.

Be aware that you can only claim your tax refund for a previous tax year within three years of the original tax returns due date or deadline. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Malaysia Corporate Income Tax Rate.

An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields. He paid Rs4 000 on 31 st May 2019 as professional tax which is Rs2 000 for the year 2018 19 and Rs2 000 for the year 2019 20. The finance minister has introduced many changes in the income tax slab rate for financial year 2019-2020 AY 2020-2021.

Malaysia has the following income tax brackets based on assessment year. Review the 2022 Malaysia income tax rates and thresholds to allow calculation of salary after tax in 2022 when factoring in health insurance contributions pension contributions and other salary taxes in Malaysia. No cash value and void if transferred or where prohibited.

Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. Within these instructions you will find the tax rate schedules to the related returns.

X is posted in the city of Hyderabad and he needs Rs2 000 yearly as a professional tax. Where the taxable profits can be attributed to the exploitation of patents a lower effective rate of tax applies. Income from RM500001.

10 Things To Know For Filing Income Tax In 2019 Mypf My

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

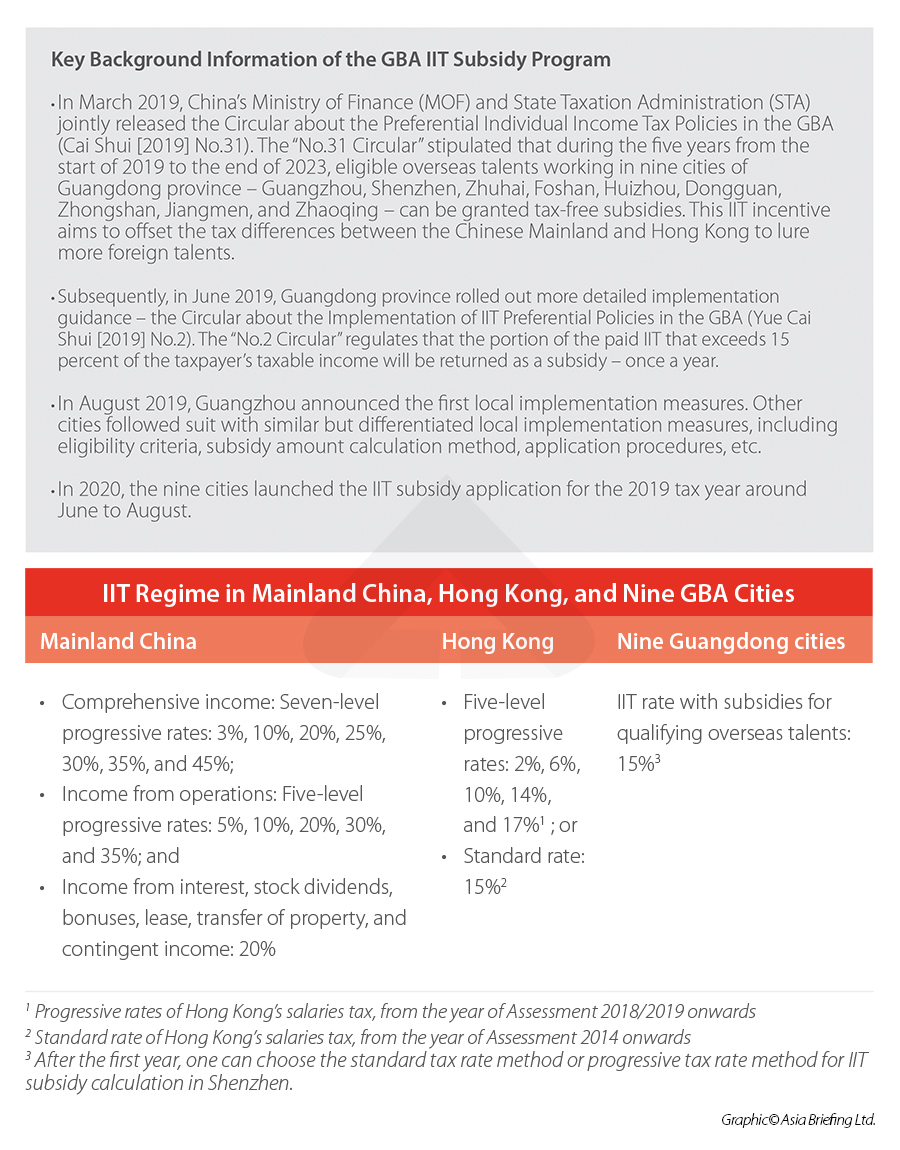

Iit Subsidies In China S Greater Bay Area File Your 2021 Application Now

The Global Soda Tax Experiment

Malaysia Personal Income Tax Guide 2020 Ya 2019

Why It Matters In Paying Taxes Doing Business World Bank Group

Malaysian Tax Issues For Expats Activpayroll

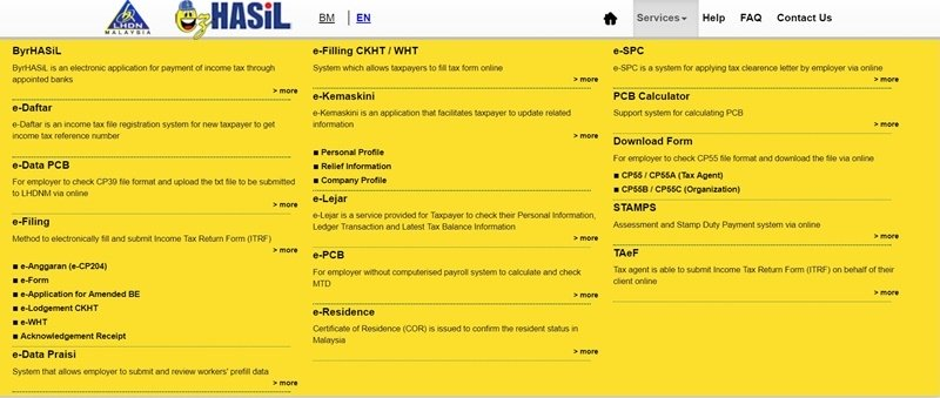

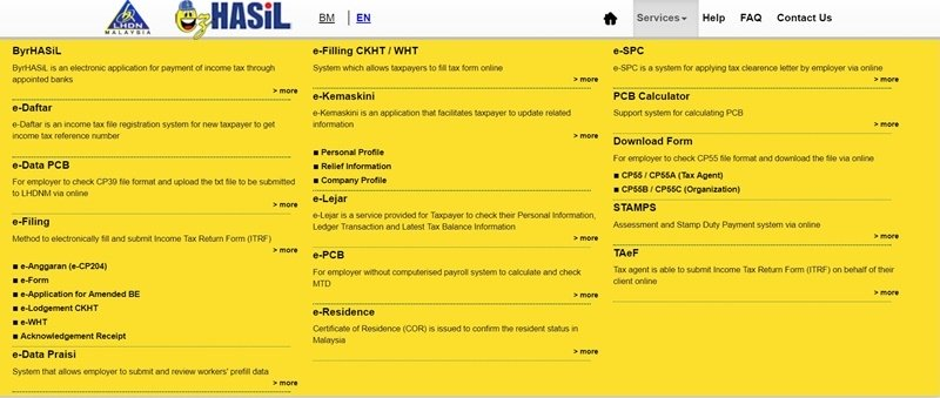

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

St Partners Plt Chartered Accountants Malaysia Malaysia Income Tax An A Z Glossary Want To File Your Income Tax In Malaysia 2019 But Don T Know What Half The Terms Mean From

Sri Lanka S Income Tax Rates Less Than Regional Peers

Taxplanning What Is Taxable In Malaysia The Edge Markets

How Much Does The Federal Government Spend On Health Care Tax Policy Center

Malaysia Personal Income Tax Guide 2020 Ya 2019

Borang Tp 1 Tax Release Form Dna Hr Capital Sdn Bhd

0 Response to "income tax rate malaysia 2019"

Post a Comment